Welcome to Denmark

Doing business here is like a walk in the park. Easy, green, and rewarding. Let us walk you through your opportunities.

Copenhagen is for you

Think outside the box and help us find a different way of doing business and living sustainably. Define what Copenhagen is to become.

Join the Capital of Life Science

Where science meets life in the perfect way.

Copenhagen is the best place in Europe to do business.

We usually don’t like to brag, but the numbers speak for themselves…#1 Least Corrupt Country in the World

#1 in Europe on EU and Regional Innovation Scoreboards 2023

9 consecutive years as Europe’s

1st on the Doing Business Index

130% in tax reduction

for R&D expenses

70% of Denmark’s electricity

is powered by renewables

#1 in the EU’s Digital Economy

and Society Index 2021

#3

worldwide in the United Nations

SDG Report 2021

- What we do

- For international businesses

- For local businesses

- For Denmark and beyond

We attract international companies, investment, and professional talent to ensure continuous, sustainable growth in Denmark and in the Greater Copenhagen Region.

We do this by promoting our metropolitan region and country globally and using our network and experience across industry, academia, and the public sector to guide our customers through their opportunities.

Find out more about us

From the moment you are considering Denmark as an option, to the moment you are ready to expand your business here, we guide you every step along the way. As experts within the Life Science, Tech, and Green Transition sectors – we hook you up with our exclusive networks in the Greater Copenhagen Region.

Get started!

In a highly competitive labour market, we can help you employ and retain the world’s best!

Our talent attraction team is working relentlessly to nurture a competitive talent pool and match your business with the right highly qualified professionals that will take your business to the next level.

You probably recognise us from a series of masterful campaigns and established place brands such as the Greater Copenhagen Region, State of Denmark, Headstart, Medicon Valley, and Copenhagen Goodwill Ambassadors, to name a few!

Employ the world’s best

We make your life easier by introducing international professionals to your business.

Here are our latest talent attraction campaigns.

What's new?

- All

- News

- Events

BioJapan 2024

Join us at Asia's largest partnering event in Yokohama 9-11th of October. Book a meeting with us via the event platform.

Career Fair at Bloxhub

Dive into the future of sustainability, urban design and buildings at Bloxhub and Copenhagen Capacity's Career Fair, connecting international professi...

Flux Partners Chooses Copenhagen Over Stockholm for Nordic Headquarters

We are thrilled to announce that Flux Partners, a leading consultancy firm has chosen Copenhagen as the location for its Nordic headquarters.

Copenhagen Attracts Foreign Workers: A Leading Destination in the Nordics

In a recent study, Denmark emerged as the top destination for foreign workers in the Nordic region, ahead of its neighbours Sweden, Norway, and Finlan...

Asia Bio Partnering Forum 2024

Join us at this event gathering biotech and pharma leaders in Singapore 24-25th of April. Book a meeting with us via the event platform.

Career Fair at the LOOP Forum

Join this LOOP Forum career fair where Clean - Danish Cluster for Water and Environmental Technology showcases 20+ companies driving the green transit...

Science Hub Denmark is launched to attract top international researchers

We are proud to announce the launch of Science Hub Denmark – a 3-year pilot project in a collaboration between the Novo Nordisk Foundation, Lundbeck F...

BIO-Europe Spring 2024

Join us at the premier springtime partnering event in Barcelona 18-20th of March. Book a meeting with us via the event platform.

International Talent Conference 2024

Join the conference and meet +150 highly motivated international students currently living in Denmark, with in-demand skills.

Copenhagen Welcomes Yingli Solar's Expansion into Denmark's Green Energy Sector

We are thrilled to announce that Yingli Solar, a frontrunner in the global solar energy industry, has chosen Denmark for its latest expansion. This st...

MIT European Career Fair 2024

Join the delegation of Danish companies and meet some of the world’s best STEM candidates at MIT.

World-leading semiconductor manufacturer is expanding with 125 jobs in Frederikssund

Topsil, a Danish company founded in 1959 and acquired by GlobalWafers from Taiwan in 2016, is announcing a major expansion initiative within Denmark, ...

Benefits vs drawbacks of hiring internationals in Danish SMEs

Tina Høst Jørgensen, co-owner of ProMeasure, remembers when an international employee could not accept that she - a woman - was his “boss” and told Ti...

Tokyo-based DeepTech Company Scurid Expands to Copenhagen

Based in Tokyo, Scurid leads the way in providing autonomous digital identity and trust for IoT data across various industry verticals. Scurid’s user-...

International partnering, strategy and investment for Nordic life science executive leaders

Create strategic partnerships and collaboration with key international healthcare stakeholders!

Ukrainian Software company Defies War and Opens Nordic Headquarter in Copenhagen

Despite the ongoing Russian invasion of Ukraine, IT company Diceus, based in Kyiv, has chosen to open a Nordic headquarters in Copenhagen to strengthe...

Innovation Challenge for SMEs

Access knowledgeable talent with a global perspective from various educational backgrounds and unleash your innovation.

Beta Mobility Expands to Copenhagen: Accelerating Green Mobility Solutions in the Nordics

As an integrated Management Consultancy and Startup Studio, Beta Mobility aims to drive innovative solutions for sustainable urban mobility. This expa...

Green Urban Futures Network & Mingle

Join us at this after-hour networking event and experience the region from above.

Copenhagen Capacity To Secure Critical Competencies for Denmark's Green Transition

To successfully transition into a greener Denmark, we will need 50,000 - 100,000 extra employees by 2030, and currently, there is a shortage of the ri...

Let’s get in touch

- Investment Promotion

- Marketing

- Strategy & Innovation

- Talent

See what people say about us…

"We chose Copenhagen because of its prime location with access to a large talent pool in Greater Copenhagen, covering Eastern Denmark and Southern Sweden. In Copenhagen, we felt we could create a Nordic headquarters with a high level of professionalism, and this turned out to be true.”

“The war for talents is real and in the search for the best talents we joined a partnership with Copenhagen Capacity where they have helped us expose our open jobs towards international talents in and outside Denmark. We have learnt a lot from their expertise in place branding and digital recruitment.”

“We are very grateful for Copenhagen Capacity’s assistance, which clarified the benefits of growing our staff in Denmark. I am thrilled that our new domicile in Copenhagen will have even more skilled employees.”

“I am really impressed by the candidates delivered, the effectiveness of the talent attraction campaign and the quality delivered by Copenhagen Capacity. Compared to candidates we’ve received from recruitment companies. I am impressed with the level and wide reach. It has been a pleasure working with Copenhagen Capacity.”

“Before we opened our office in Copenhagen, we wanted a general view of the sales potential and recruitment opportunities. Copenhagen Capacity was a huge help in creating this overview.”

“It is easy, manageable, and associated with very low risk to establish a business in Denmark. For this reason, we also expect relatively fast to get the first customers in house and create sales in the business.”

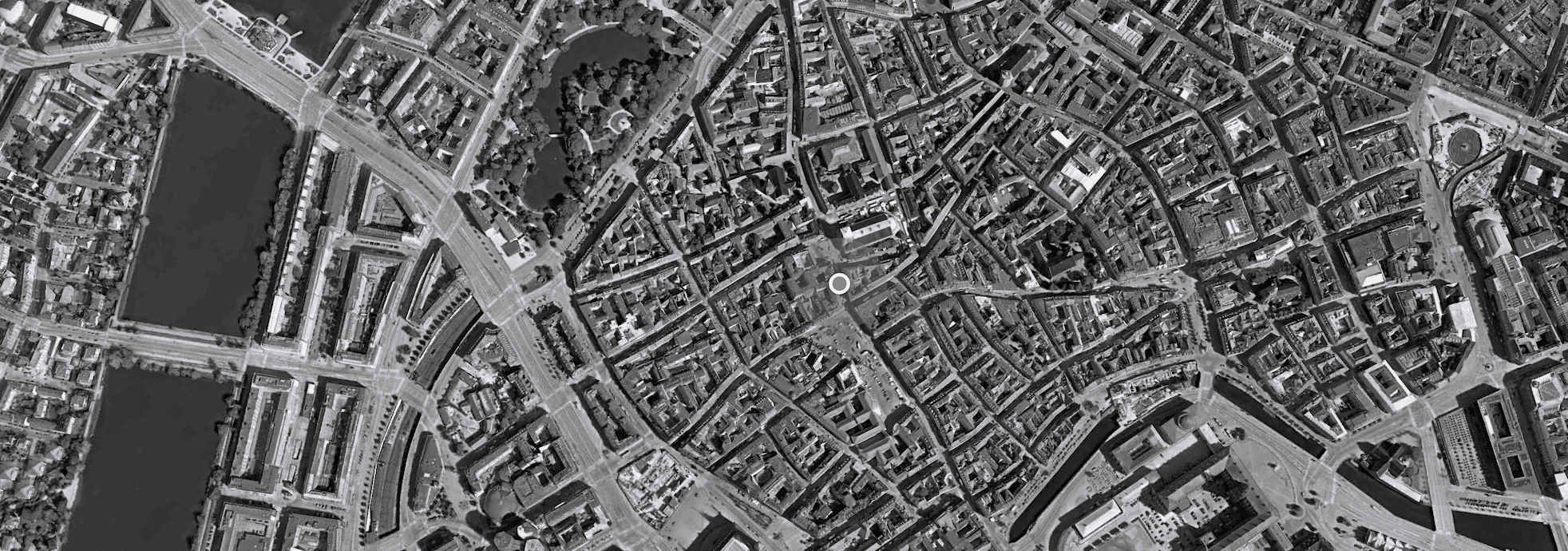

Office locations

Copenhagen Capacity

Main office

Nørregade 7b

1165 Copenhagen

Denmark

contact@copcap.com

VAT Number: DK17538896

Zealand

Fulbyvej 15

4180 Sorø

Zealand

Allan Lyhne

Investment Manager

Head Of Zealand Hub

+45 30515625

allan@copcap.com

Nørregade 7b

1165 Copenhagen

Denmark